salt tax cap explained

12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT. Given that 10000 cap on the SALT deduction you would need to find more than 2200 in deductions elsewhere to.

How Does The State And Local Tax Deduction Work Ramsey

In the first scenario your 10000 contribution saves you 11200 in taxes a 7500 state credit and a deduction worth 3700 in federal tax savings at the 37 percent top.

. Leaders are trying to. December 12 2021 930 AM 4 min read. The House of Representatives passed a bill last week that would make permanent the individual provisions of the Tax Cuts and Jobs Act TCJA.

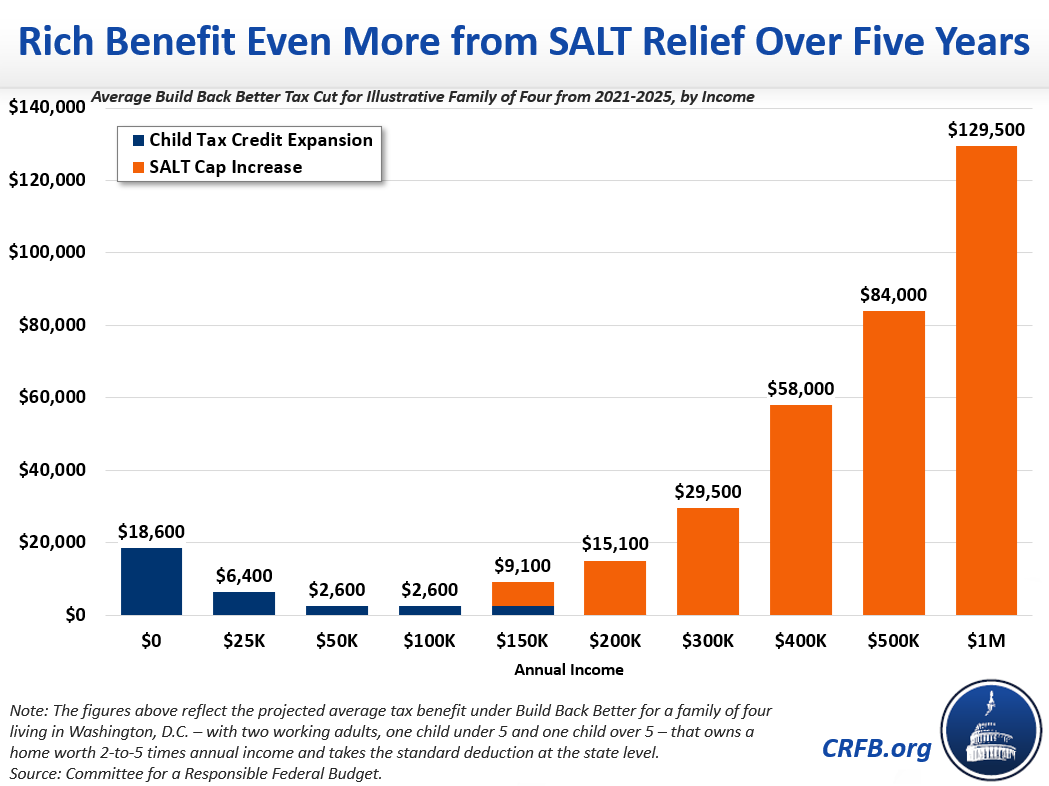

But you must itemize in order to deduct state and local taxes on your federal income tax return. About 256 million fewer tax returns used the SALT deduction the year after the cap was put in place. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

As alternatives to a full repeal of the cap lawmakers and. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately.

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. The 2017 Tax Cuts and Jobs Act TCJA put a cap on such deductions but recently a number of lawmakers are advocating for. In 2018 Trump placed a cap on the SALT deduction in order to recover revenue lost from various tax cuts.

Higher-tax states such as California New York New Jersey and Pennsylvania. One such provision is the. How does the property tax deduction differ from the overall SALT deduction.

The federal tax reform law passed on Dec. But some policymakers are pushing to get rid of it. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

This was true prior to the SALT deduction cap and remained the case in 2018. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax. Second the 2017 law capped the SALT deduction at 10000 5000 if.

The Tax Cuts and Jobs Act placed a temporary cap on the SALT deduction and that cap is set to end after the tax year 2025. Salt tax cap explained Thursday June 23 2022 Edit. How to lower your chances of an IRS tax audit 0252.

The Tax Cuts and Jobs Act. The rich especially the very rich. Now the SALT tax cap is set to expire in 2025.

The SALT deduction tends to benefit states with many higher-earners and higher state taxes. This cap remains unchanged for your 2021 taxes and it will remain the same in. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called.

As for the House bills 10000 cap on the property tax deduction the average deduction claimed.

The State And Local Tax Deduction Cap Explained Usafacts

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Unlock State Local Tax Deductions With A Salt Cap Workaround

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The Salt Cap Overview And Analysis Everycrsreport Com

Legislation Introduced In U S House To Restore The Salt Deduction

Salt Cap Increase Ok D By House Now Heads To Senate What May Change

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

Democrats Consider Tax Cuts For Many High Earners In New York New Jersey And California Wsj

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction What It Is How It Works Bankrate

House Democrats Add Paid Leave State And Local Tax Deduction To Bill Wsj

/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

/GettyImages-56970357-5867cc515f9b586e02191b68.jpg)